Budgeting For College Students : A Step By Step Guide

For an average college student, the expenses of attending college are overwhelming and a major cause of stress. Reports show that 75% of students experience moderate to high financial distress, 65 percent consider themselves “financially unstable,” and 45 percent say they can’t adequately cover basic needs, such as food and housing. This financial strain and the stress it causes can negatively impact the academic, social, and personal aspects of our college experience.

Academically, financial strain sometimes leads to prioritizing work over study – picking up more shifts or working extra hours – to make more money. Doing this can negatively impact our academic performance. Socially, the need to save money or cut costs might discourage us from hanging out with friends or attending paid social events. On a personal level, the stress from financial strain takes a toll on our mental, physical and overall wellbeing.

While financial challenges may not disappear entirely, we can learn to manage them effectively through tools like budgeting. A budget is a plan that helps you manage your money so you can spend and save wisely and work towards your financial goals. A budget makes it easier to compare your expenses and cut back if needed. It helps you figure out where your money is going, what you can afford to spend on things like rent and other payments to ensure you don’t take on too much debt or cause yourself financial stress.

There are several budgeting methods, but my favourite is the zero-based one, which I will teach in this post. I love it because it helps you account for every dollar and prevents impulse purchases.

The most popular budgeting method is arguably the 50/30/20 one. My main issue with that approach is that it doesn’t work for students who make just enough to get by or to support themselves minimally in college in some financial way. For example, my rent takes about 74% of my total income, so the 50/30/20 method doesn’t work for me.

Another popular method is the Pay Yourself First method. My issue with that is that sometimes my income fluctuates, so I find it difficult to commit to saving a fixed percentage or amount every month. Also, it creates unnecessary pressure on me because by prioritizing saving, I sometimes fall short of the amount needed to cover my necessary expenses.

These are my opinions, and I chose to use the zero-based budgeting method based on my type of income and lifestyle. The budgeting methods that didn’t work for me might work for you. All that matters is to find a budgeting method that works for you and to stick with it. Also, know when to modify your budgeting method to suit your needs over time.

Let’s get started with the zero-based budgeting method!

Some reasons why I love the zero-based budgeting method

- It provides clarity on your spending habits and helps prevent or cut back on overspending or impulse purchases.

- It allows flexibility

- It prioritizes essentials while allowing flexibility (like saving and focusing on goals) with the remaining funds.

HOW IT WORKS

THE FIRST STEp

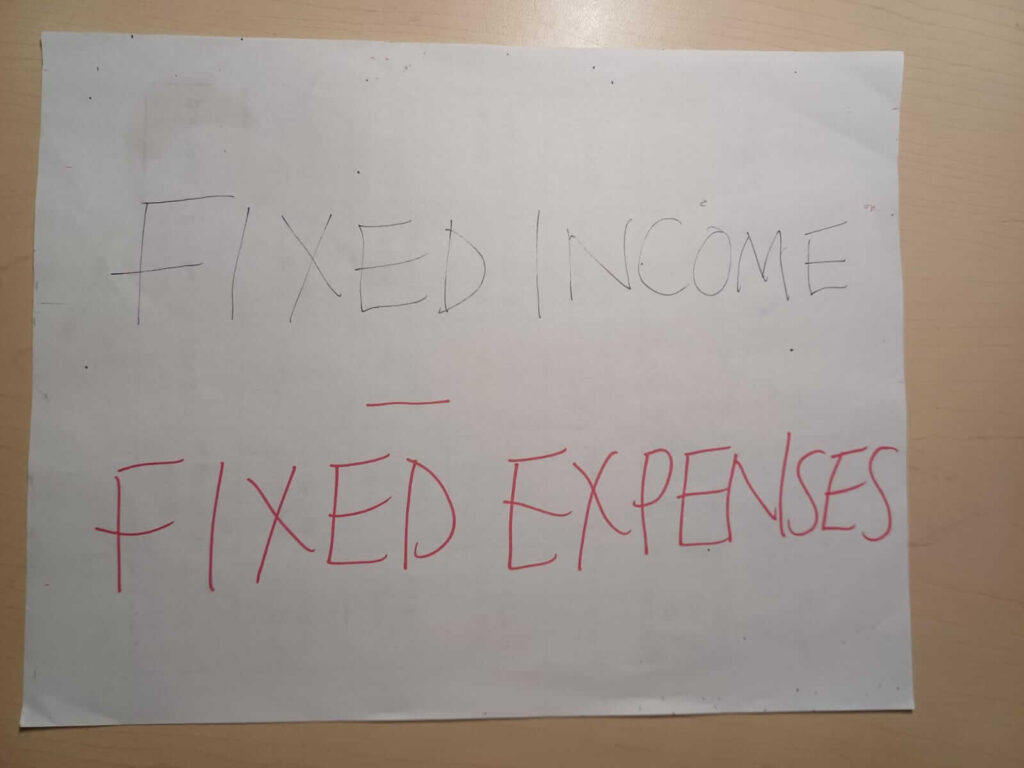

Calculate your fixed income (or total income).

Start with writing down and calculating all the various sources of income you have and how much you make or receive from each source. This can be income from your job(s), fixed (monthly) allowance from your parents or someone else, or scholarships.

The sources of income you list or include in your budget should be fixed. That is, it should be an amount you are (almost)100% sure you would receive. Ensuring you include only fixed income will prevent you from overstating or understating your income, which can lead to over- or under-budgeting.

STEP 2

The second step involves identifying and listing your fixed expenses.

Your fixed expenses are rent, utilities, groceries, transportation, essential monthly payments (maybe debt repayment) or tuition. These are your non-negotiable costs.

After deducting your fixed expenses from your fixed income, allocate the remaining amount.

STEP 3

Allocate the remaining amount (Leftover/Disposable Income).

You should allocate and account for any amount left after covering fixed expenses. Remember, the aim of the zero-based budgeting method is to allocate for every dollar. That is, total income-total expenses must be equal to zero.

The first thing you should allocate your disposable income to is savings. You should ensure you save whenever possible, no matter how small (even if it’s a dollar, 5 or 10). The next thing to allocate to is your wants. These are things like entertainment, dinners out, luxury or other discretionary spending.

Also, always set aside some money for things you reward yourself with after an exam or a stressful day or week.

Remember, the goal is to ensure that after subtracting the cost of fixed expenses and the disposable income from your fixed income, it should equal zero. This helps you to ensure you know where every dollar is going and account for it.

Also, the aim is not to spend everything you earn but to assign a job to every dollar of your income.

Always remember that you work too hard for your money to lose track of it!

Are there other ways you budget in college? Please share them in the comments!

Thank you for reading!